Being wealthy isn’t just about earning a high salary. It’s about how you manage, grow, and protect your money. In fact, the biggest difference between rich and poor people often lies in their daily habits and mindset. Understanding how financially successful people think and act can help you take control of your own financial future.

In this article, we’ll explore 11 simple habits that commonly separate the rich from the poor, and explain why learning about money – called financial literacy – is so important.

1.0 Rich People Believe They Create Their Own Life. Poor People Believe Life Happens to Them.

Rich people usually have a “growth mindset” – the belief that they can improve their life through effort and learning (Dweck, 2006). Poor people may feel stuck or helpless, often blaming their problems on outside forces. To grow wealth, it helps to believe that you are in charge of your financial future.

2.0 Rich People Set Goals. Poor People Let Life Decide for Them.

Wealthy people set specific goals for their money – like buying a home or starting a business. This keeps them focused. Poor people may drift from one financial crisis to another because they haven’t planned where they want to go (Tracy, 2004).

3.0 Rich People Think Big. Poor People Think Small.

Rich people dream big and don’t limit their possibilities. Poor people often set small goals because they fear failure. Thinking big encourages innovation, ambition, and progress (Hill, 2016).

4.0 Rich People Focus on Opportunities. Poor People Focus on Problems.

While poor people often dwell on obstacles, the wealthy are more focused on finding solutions and opportunities. They ask, “How can I make this work?” rather than “Why is this happening to me?” (Kiyosaki, 1997).

5.0 Rich People Learn from Other Successful People. Poor People Often Feel Envious or Critical.

Instead of feeling jealous, rich people study others who’ve succeeded. They read books, attend seminars, and get advice from mentors. Poor people may push successful people away due to resentment or misunderstanding (Gladwell, 2008).

6.0 Rich People Are Not Afraid to Promote Themselves or Their Work. Poor People Avoid Selling.

Successful people understand that promoting their skills, business, or ideas is necessary. Poor people often think self-promotion is boastful or uncomfortable, but in truth, marketing yourself is a key to opportunity (Pink, 2013).

7.0 Rich People Get Paid for Results. Poor People Get Paid for Their Time.

The wealthy focus on ways to earn money based on outcomes – like profits from a business or investment returns. Poor people usually work hourly or salaried jobs. This limits how much they can earn, no matter how hard they work (Malkiel & Ellis, 2012).

8.0 Rich People Build Assets That Make Money. Poor People Rely on Their Jobs.

Rich people build passive income – money that keeps coming in even when they’re not working, like rent from property or stock dividends. Poor people rely mostly on their wages, which stops when they do (Damodaran, 2012).

9.0 Rich People Focus on Net Worth and Cash Flow. Poor People Focus Only on Salary.

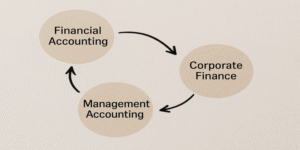

Rather than only thinking about income, the rich track their net worth (what they own minus what they owe) and cash flow (money in versus money out). This gives a clearer picture of long-term financial health (Gitman et al., 2015).

10.0 Rich People Keep Learning. Poor People Think They Know It All.

The wealthy never stop educating themselves about money, investing, and life. They read books, attend courses, and adapt to changes. Poor people may stop learning after school, which can hold them back (OECD, 2020).

11.0 Rich People Make Their Money Work for Them. Poor People Work Hard for Money.

Instead of working harder, rich people invest in assets that earn money over time – like businesses, stocks, or property. Poor people may work long hours but never put their money to work for them (Siegel, 2014).

Why Financial Literacy Matters

Being financially literate means you understand how money works – how to earn it, save it, invest it, and protect it. According to Lusardi and Mitchell (2014), financial literacy is directly linked to smarter financial choices and long-term stability.

Here’s why it’s vital:

- You make better decisions about loans, credit cards, savings, and investments.

- You avoid debt traps and plan for the future.

- You build financial independence, which means more freedom and less stress.

- You help your family and future generations by passing on financial knowledge.

Final Thoughts

Success with money doesn’t happen overnight – it comes from learning, changing your mindset, and developing good habits. By following these 11 habits and committing to financial literacy, you can move from surviving to thriving.

References

Damodaran, A. (2012) Investment Valuation: Tools and Techniques for Determining the Value of Any Asset, Wiley.

Dweck, C. S. (2006) Mindset: The New Psychology of Success, Random House.

Gitman, L. J., Joehnk, M. D., & Smart, S. B. (2015) Fundamentals of Investing, Pearson.

Gladwell, M. (2008) Outliers: The Story of Success, Little, Brown.

Hill, N. (2016) Think and Grow Rich, Vermilion.

Kiyosaki, R. T. (1997) Rich Dad Poor Dad, Warner Books.

Lusardi, A. and Mitchell, O. S. (2014) ‘The Economic Importance of Financial Literacy: Theory and Evidence’, Journal of Economic Literature, 52(1), pp. 5–44.

Malkiel, B. G. & Ellis, C. D. (2012) The Elements of Investing, Wiley.

OECD (2020) Financial Literacy and the Need for Lifelong Learning. Available at: https://www.oecd.org/finance/financial-education/

Pink, D. H. (2013) To Sell Is Human, Canongate Books.

Siegel, J. J. (2014) Stocks for the Long Run, McGraw-Hill Education.

Tracy, B. (2004) Goals!, Berrett-Koehler.