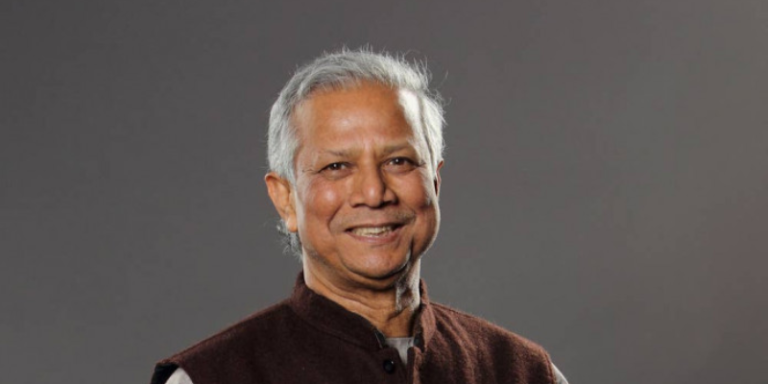

Dr Muhammad Yunus, often referred to as the “Banker to the Poor,” is a Nobel laureate whose innovative approach to poverty alleviation has transformed the lives of millions around the world. His pioneering concept of microfinance, which provides small loans to the impoverished without requiring collateral, has not only redefined the banking industry but also challenged conventional ideas about economics and social development.

Early Life and Education

Born in 1940 in the village of Bathua, Bangladesh (then part of British India), Dr Yunus was deeply influenced by the poverty he witnessed during his childhood. This experience sowed the seeds for his later work in social entrepreneurship. After earning a Fulbright scholarship, Yunus pursued higher education in the United States, obtaining a PhD in Economics from Vanderbilt University in 1969. He returned to Bangladesh in the early 1970s, at a time when the country was reeling from the devastation of its war of independence (Yunus, 2003).

The Birth of Microfinance

Dr Yunus’s journey towards creating the concept of microfinance began in 1976 when he was a professor at Chittagong University. He was deeply moved by the plight of the poor in the nearby village of Jobra, particularly the women who were trapped in cycles of debt due to predatory lending practices. Yunus lent $27 out of his own pocket to 42 women in the village, enabling them to buy raw materials for their small businesses. This small act of kindness revealed a significant insight: even tiny amounts of capital could make a monumental difference in the lives of the poor (Yunus, 1999).

Building on this success, Yunus founded the Grameen Bank in 1983. The bank’s model was revolutionary — loans were given without collateral, primarily to women, and were repaid in small, manageable instalments. The Grameen Bank’s focus on empowering women was based on Yunus’s belief that women are more likely to invest in their families’ welfare, thus creating a positive ripple effect in their communities. This model defied traditional banking norms and proved that the poor were creditworthy, with a repayment rate exceeding 98% (Bornstein, 1996).

Global Impact and Nobel Prize

The success of the Grameen Bank attracted global attention and led to the widespread adoption of microfinance across the world. By 2024, microfinance institutions inspired by Yunus’s model were operating in over 100 countries, providing financial services to millions of people who had previously been excluded from the formal banking system. The model has been particularly successful in empowering women, fostering entrepreneurship, and reducing poverty in some of the world’s poorest regions (Daley-Harris, 2009).

In recognition of his efforts to “create economic and social development from below,” Dr Muhammad Yunus and the Grameen Bank were jointly awarded the Nobel Peace Prize in 2006. The Nobel Committee lauded Yunus for his work in promoting economic self-reliance and his role in advancing peace and stability through economic justice (Nobel Prize, 2006).

Other Accolades and Recognition

Dr Muhammad Yunus’s groundbreaking work in microfinance and social entrepreneurship has earned him numerous accolades and recognition worldwide. Beyond the Nobel Peace Prize in 2006, Yunus has received several prestigious awards that acknowledge his contributions to global poverty alleviation and social innovation. In 2008, he was awarded the United States Presidential Medal of Freedom, one of the highest civilian honours in the United States, recognising his significant role in promoting peace and prosperity through economic empowerment (White House, 2009).

In 2009, Yunus was also honoured with the Congressional Gold Medal, the highest civilian award bestowed by the United States Congress, further solidifying his global influence in the fight against poverty. The following year, he was named one of TIME magazine’s “100 Most Influential People,” reflecting his enduring impact on both economic theory and practical development efforts (TIME, 2010).

Additionally, Yunus has been awarded over 50 honorary doctorates from universities across the globe, including Harvard University, the University of Cambridge, and the University of Tokyo. These recognitions are a testament to his enduring influence and the widespread admiration for his innovative approaches to social and economic challenges (Grameen Bank, 2024).

Legacy and Controversies

While Dr Yunus’s contributions to poverty alleviation and social entrepreneurship are widely celebrated, his work has not been without controversy. Critics have raised concerns about the high-interest rates charged by some microfinance institutions and the potential for borrower over-indebtedness. Yunus has responded to these criticisms by emphasising the need for ethical practices within the microfinance sector and calling for stronger regulatory frameworks (Bateman, 2010).

Despite these challenges, Dr Muhammad Yunus’s legacy as a pioneer of microfinance and social business remains intact. His innovative ideas have empowered millions of people to lift themselves out of poverty, proving that with the right tools and opportunities, even the poorest among us can achieve economic independence and dignity.

Recent Move to Head Interim Government in Bangladesh

As of recent developments, Dr Muhammad Yunus has been selected to head an interim government in Bangladesh, a move that has sparked significant political and public interest. His potential leadership role in this interim government comes at a critical juncture for Bangladesh, a country facing political tensions and challenges related to governance, democracy, and economic stability.

Dr Yunus’s selection is seen by many as a strategic choice, given his international stature, reputation for integrity, and proven track record in social and economic development. Supporters argue that his leadership could bring a non-partisan, technocratic approach to the interim government, focused on maintaining stability and ensuring free and fair elections. His background in microfinance and social business also positions him uniquely to address the economic challenges facing the country, particularly in empowering marginalized communities and promoting sustainable development.

However, this move is not without controversy. Critics have raised concerns about the feasibility of Yunus transitioning from his role as a social entrepreneur to the complex arena of political governance. Moreover, there are questions about the potential implications for his global initiatives, such as the Grameen Bank and social businesses, should he assume a more active role in national politics.

This development marks a significant moment in Bangladesh’s political landscape, with Dr Yunus’s involvement potentially shaping the country’s future trajectory.

References:

Bateman, M. (2010) Why Doesn’t Microfinance Work? The Destructive Rise of Local Neoliberalism. Zed Books.

Bornstein, D. (1996) The Price of a Dream: The Story of the Grameen Bank. University of Chicago Press.

Daley-Harris, S. (2009) State of the Microcredit Summit Campaign Report 2009. Microcredit Summit Campaign.

Grameen Bank (2024) “Accolades and Recognition for Dr. Muhammad Yunus”. [Online]. Available at: https://grameenbank.org/about-us/awards-and-recognitions/. [Accessed 09 August 2024].

Nobel Prize. (2006) “The Nobel Peace Prize for 2006”. [Online]. Available at: https://www.nobelprize.org/prizes/peace/2006/yunus/lecture/. [Accessed 09 August 2024].

TIME (2010) “The 2010 TIME 100: Leaders”. [Online]. Available at: https://time.com/collections/time-100/. [Accessed 09 August 2024].

Yunus, M. (1999) Banker to the Poor: Micro-Lending and the Battle Against World Poverty. PublicAffairs.

Yunus, M. (2003) A World Without Poverty: Social Business and the Future of Capitalism. PublicAffairs.

Yunus, M. (2007) Creating a World Without Poverty: Social Business and the Future of Capitalism. PublicAffairs.

White House (2009) “Presidential Medal of Freedom Recipients”. Available at: https://obamawhitehouse.archives.gov/the-press-office/2009/07/30/presidential-medal-freedom-recipients. [Accessed 09 August 2024].