Management Accounting plays a vital role in modern organisations by providing managers with timely, relevant, and forward-looking information that supports planning, control, and performance evaluation. Unlike financial accounting, which focuses on external reporting, management accounting is designed primarily for internal decision-making, equipping businesses with insights necessary for sustainable growth and competitiveness.

1.0 The Nature of Management Accounting

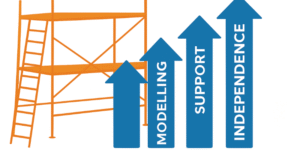

Management accounting involves collecting, analysing, and interpreting both financial and non-financial data to aid managerial decision-making. Vaivio (1999) highlights that management accounting has evolved beyond purely financial measures, now incorporating customer satisfaction, employee performance, and sustainability indicators. This evolution reflects the importance of intangible assets in knowledge-driven economies, where factors such as brand value and innovation drive competitive advantage.

Banerjee (2012) further argues that management accounting serves as the backbone of strategic planning, enabling firms to assess risks, forecast outcomes, and allocate resources effectively. This broader scope helps organisations address dynamic business challenges, from economic volatility to digital transformation.

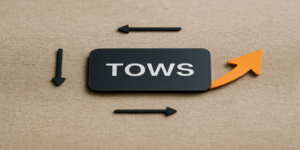

2.0 Key Techniques in Management Accounting

2.1 Budgeting

Budgeting provides a detailed financial plan that guides future operations. Traditional budgeting involves estimating revenues, costs, and cash flows over a specific period. However, modern approaches such as rolling forecasts and beyond budgeting models allow for more flexibility (Golyagina & Valuckas, 2012).

For example, Tesco applies flexible budgeting to adapt its operations to fluctuating consumer demand. This enables it to reallocate resources quickly during periods of economic uncertainty, such as the COVID-19 pandemic.

2.2 Cost Analysis

Cost analysis determines the cost structure of products and services, supporting pricing strategies and profitability assessments. Traditional methods such as standard costing have been supplemented by Activity-Based Costing (ABC), which allocates overheads based on actual activities. Melese, Blandin, and O’Keefe (2004) note that integrating ABC with the Balanced Scorecard provides a powerful framework for linking costs with strategic objectives.

A practical case is Unilever, which has implemented ABC to understand production costs across diverse product lines. This has improved decision-making on whether to continue or discontinue certain products based on profitability analysis.

2.3 Variance Analysis

Variance analysis compares actual results with planned outcomes to identify discrepancies. According to Efendi, Fauzi, and Putri (2025), variance analysis is essential for cost control and accountability, particularly in complex organisations with multiple business units. For instance, in hospital management, volume variance analysis helps evaluate whether patient service levels meet budget expectations (Vesty & Brooks, 2017).

2.4 Financial Forecasting

Financial forecasting predicts future outcomes using historical data, industry trends, and statistical models. In small and medium enterprises (SMEs), effective forecasting enables better cash flow management and reduces bankruptcy risk (Okeke, Bakare & Achumie, 2024). Techniques range from regression analysis to advanced AI-driven forecasting models such as LSTM neural networks (Ayvaz, Kaplan & Kuncan, 2020).

Airbus, for instance, relies heavily on financial forecasting when planning large-scale aircraft production, given the long lead times and high capital investments involved.

3.0 Strategic Role of Management Accounting

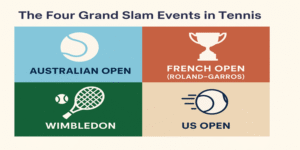

3.1 Performance Measurement and Evaluation

Management accounting enhances organisational performance measurement through frameworks like the Balanced Scorecard (Kaplan & Norton). This tool integrates financial and non-financial indicators across four perspectives: financial, customer, internal processes, and learning and growth. Nielsen (2023) demonstrates how combining the Balanced Scorecard with time-driven activity-based costing (TD-ABC) offers richer insights into cost drivers and performance outcomes.

British Airways, for example, has adopted the Balanced Scorecard to align its operational metrics—such as on-time arrivals and customer satisfaction—with broader financial goals.

3.2 Strategic Cost Management

Strategic cost management integrates cost analysis with organisational strategy. Chenhall and Langfield-Smith (1998) reveal that aligning management accounting techniques such as benchmarking and ABC with strategic priorities improves competitiveness.

In the automotive sector, Toyota uses lean cost management, combining variance analysis and activity-based costing to reduce waste and improve operational efficiency.

3.3 Business Analytics Integration

Recent research highlights the growing integration of business analytics into management accounting (Nielsen, 2015). Predictive analytics combined with traditional budgeting and forecasting provides organisations with early warning systems for financial risks (Ayvaz et al., 2020).

Banks, for instance, employ rolling forecasts supported by analytics tools to predict customer defaults and manage credit risks more proactively (Bjørnenak, 2013).

4.0 Examples Across Industries

- Food and Drinks Industry: Abdel-Kader and Luther (2006) found that budgeting remains a central management accounting practice in the UK’s food and drinks sector, but firms are increasingly exploring Balanced Scorecards for holistic performance evaluation.

- Hospitality Sector: Pavlatos and Paggios (2008) report that Greek hotels use budgeting, cost control, and Balanced Scorecards to improve profitability while maintaining service quality.

- Public Sector: Melese et al. (2004) highlight the adoption of management accounting tools in government organisations, integrating ABC and Balanced Scorecards to improve transparency and accountability.

These examples illustrate the adaptability of management accounting techniques across industries and sectors.

5.0 Challenges and Future Directions

Despite its benefits, management accounting faces several challenges:

- Implementation resistance: Employees may resist new accounting systems due to training costs or perceived complexity.

- Relevance: Traditional budgeting is criticised for being inflexible in volatile environments (Golyagina & Valuckas, 2012).

- Data overload: With the growth of big data, management accountants must filter vast amounts of information to extract actionable insights (Ferzizi, 2021).

Future directions suggest greater reliance on digital technologies such as AI, machine learning, and blockchain to enhance accuracy and real-time decision-making. Furthermore, the integration of sustainability metrics into management accounting will become increasingly significant as businesses respond to environmental and social governance (ESG) demands.

Management Accounting is an essential discipline for modern business strategy. Through techniques such as budgeting, cost analysis, variance analysis, and financial forecasting, it equips managers with tools to plan, control, and evaluate operations. Its strategic role, particularly through frameworks like the Balanced Scorecard and the integration of business analytics, ensures that organisations can remain competitive in complex environments.

By linking financial and non-financial measures, management accounting provides a decision-support framework that fosters efficiency, innovation, and long-term value creation. From SMEs to global multinationals, and across both private and public sectors, management accounting continues to evolve as an indispensable tool for organisational success.

References

Abdel-Kader, M. & Luther, R. (2006). Management accounting practices in the British food and drinks industry. British Food Journal, 108(5), pp.336–357. [https://papers.ssrn.com/sol3/Delivery.cfm?abstractid=1358339]

Ayvaz, E., Kaplan, K. & Kuncan, M. (2020). An integrated LSTM neural networks approach to sustainable balanced scorecard-based early warning system. IEEE Access, 8, pp.122–138. [https://ieeexplore.ieee.org/abstract/document/8995520/]

Banerjee, B. (2012). Financial Policy and Management Accounting. 2nd ed. New Delhi: PHI Learning.

Bjørnenak, T. (2013). Management accounting tools in banks: are banks without budgets more profitable? In: Managing in Dynamic Business Environments. Cheltenham: Edward Elgar.

Chenhall, R.H. & Langfield-Smith, K. (1998). The relationship between strategic priorities, management techniques and management accounting: an empirical investigation. Accounting, Organizations and Society, 23(3), pp.243–264.

Efendi, R., Fauzi, F. & Putri, A. (2025). Managerial Accounting Strategies to Improve Efficiency and Effectiveness of Operational Costs. The Journal of Academic Science, 12(3), pp.145–160.

Ferzizi, I. (2021). The linkage between Balanced Scorecard and Activity-Based Costing as a strategic cost management tool. ESC Alger Working Papers.

Golyagina, A. & Valuckas, D. (2012). Reviewing literature on rolling forecasts, benchmarking and customer profitability: A management accounting perspective. NHH Working Papers. [https://openaccess.nhh.no/nhh-xmlui/bitstream/handle/11250/169653/valuckas%202012.PDF]

Melese, F., Blandin, J. & O’Keefe, S. (2004). A new management model for government: integrating ABC, the Balanced Scorecard and TQM. Naval Postgraduate School Working Paper.

Nielsen, S. (2015). The impact of business analytics on management accounting. SSRN Working Paper. [https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2616363]

Nielsen, S. (2023). Business analytics: an example of integration of TD-ABC and the Balanced Scorecard. International Journal of Productivity and Performance Management, 72(6), pp.1402–1420.

Okeke, N.I., Bakare, O.A. & Achumie, G.O. (2024). Forecasting financial stability in SMEs: A comprehensive analysis of strategic budgeting and revenue management. Open Access Research Papers.

Pavlatos, O. & Paggios, I. (2008). Management accounting practices in the Greek hospitality industry. Managerial Auditing Journal, 23(1), pp.81–99.

Vaivio, J. (1999). Exploring a ‘non-financial’ management accounting change. Management Accounting Research, 10(4), pp.409–437.

Vesty, G. & Brooks, A. (2017). St George Hospital: Flexible budgeting, volume variance, and balanced scorecard performance measurement. Issues in Accounting Education Teaching Notes, 32(3), pp.11–25.